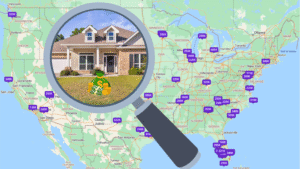

Find Profitable Rental Properties

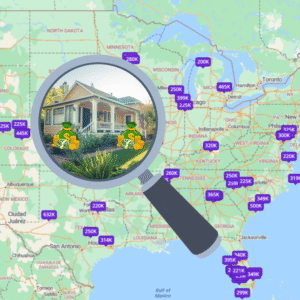

Anywhere in the US

Sample picks across the US

423 Crocus Ln, Sylva, NC 28779

3260 State Highway 55, Florala, AL 36442

220 Donnington Court, Aiken, SC 29801

3621 Beutel Rd, Lorena, TX 76655

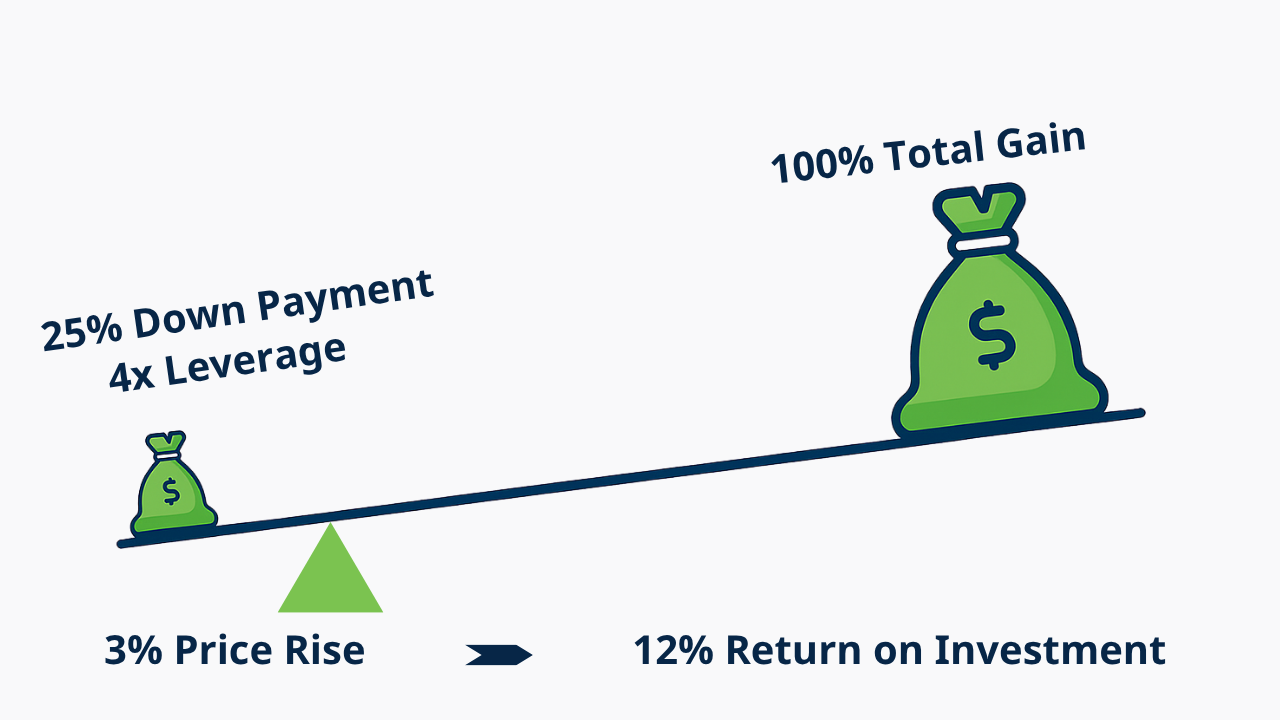

Why Add Real Estate To Your Portfolio?

Common Hurdles In Real Estate Investing

Butterflo solves these common challenges faced by investors that current tools in the market do not address.

Can't Get Good Deals Locally

Many metros have expensive properties that make finding positive cash flow opportunities nearly impossible in your own backyard.

Difficult To Find Remote Profitable Properties

Today's listing sites don't support profit-based search, leaving investors guessing where to find the best opportunities.

Tedious Financial Analysis

Rents, property taxes, and vacancy rates vary across cities. Analyzing hundreds of properties manually takes a lot of time and effort.

How To Find Local Realtors

Finding good realtors and property managers in distant cities for tenant management and maintenance is difficult without local connections.

How Butterflo Works

Here is the Simple 3-Step Journey to Finding and Owning Your Rental Property

Each investor is unique. Save time by setting your preferences and profit goals, such as:

- •Location and price range

- •Cash income vs total return

- •Cash vs. loan purchase

Unlike primary home buyers, investors care more about financial health:

- •Profit-focused search filters

- •Thorough financial analysis

- •No spreadsheets required!

Find a property, and we'll connect you with local professionals:

- •Profit-focused agents

- •Local realtors to make offers

- •Property managers for maintenance

Tips And Insights

Our blog provides investors with clear insights, expert tips and practical guides for property investing.